Recent Storm Damage Posts

Flood Prevention Can Be Basic | SERVPRO of East Brownsville & South Padre Island

4/1/2024 (Permalink)

SERVPRO of East Brownsville & South Padre Island is ready to help in a moments notice after spring showers leak in to your home or business.

SERVPRO of East Brownsville & South Padre Island is ready to help in a moments notice after spring showers leak in to your home or business.

When you think about how to do something well, you almost always have to go back to the basics. Teaching your kids how to do math is a prime (no pun intended) example of this—starting with the simple steps is the best way to learn a new skill with as few tears as possible.

Protecting your home from disasters can be simple, too. With some basic home maintenance, you can prepare your home for just about anything Mother Nature can throw at it.

Flooding is one of the top ways that homes across the nation are damaged every year, which makes it one of the natural disasters you want to ensure you are always prepared for.

Know Your ZoneWater damage can happen in a lot of ways, including plenty that don’t originate from outside. While manmade disasters like a leaking appliance can cause a major disruption in your home, they are often easier to control and recover from than something nature sends our way. With so much water around our community, we are all susceptible to coastal flooding, flash floods or just ponding water from our commonly heavy rains.

With such a high flood risk from storm surge during hurricane season, it is important to get to know where your home falls in the flood zone. You need to understand just how much risk you are facing in order to get the best idea of how much preparation you will need to do.

Along with understanding where you fall in the flood zones, you need to get to know your yard. Homes in low-lying areas may be susceptible to flooding with just a light rain. If you fall into this category, adding extra drainage to your yard can be extremely helpful in preventing ponding water that could seep into your home.

If your yard includes leaf-dropping trees, investing in gutter covers can be a great way to keep things flowing. You should also check your roof at least twice a year for any signs of aging or other damage, as well as after high-wind events. Get as familiar with the area your home is in in order to keep it as safe as possible.

Prepare to PreventAlong with understanding how your home falls within the floodplains, there is some other action you can take around your home to be prepared for anything that comes our way. Take some time to keep your yard prepared so that water constantly moves away.

Your yard should have a gentle slope away from your house. After a rain, check for areas that are staying wet and muddy. You may need to add organic materials or even consider a rain garden in these spots to pull water down through the earth. You can also take your gutter downspouts underground if they are surface level. This will carry water immediately away and lowers the chances of damage to your gutter system during high winds.

To add a little extra protection inside your home, put checking window and door seals on your seasonal to-do list. Add caulking to any areas that are showing signs of aging, and add weather stripping to keep things tightly sealed against the elements. If you have hurricane shutters, close them long before the first storm can blow in to make sure they are in good shape.

If you have a basement, keep a close eye on corners and edges in order to catch cracks or loose seals. Make sure you have a sump pump in good working condition so water can be pumped out when coastal flooding starts moving inland.

When it comes to getting prepared for potential flood disasters, keep it simple. Add basic yard and home maintenance to your regular to-do list in order to ensure everything is in good shape. Protecting your home will be far easier than helping your kids finish their math homework.

Do you have water damage in your home? Contact us at SERVPRO® for fast recovery.

Preparing for Spring Storms | SERVPRO® of East Brownsville & South Padre Island

4/1/2024 (Permalink)

The warm weather of spring has arrived, and we know for our Texas home that means that plenty of rain and severe storms can come right along with it. It isn’t uncommon to see thunderstorms, flash flooding and even the occasional early season tropical-style storm during the spring months.

As spring pushes toward summer, the weather can intensify and the official hurricane season starts. With potentially volatile weather headed our way, it is important to be prepared.

All the preparations in the world won’t matter if you don’t have a way to receive weather alerts. Staying informed is one of the most important things you can do in order to safely ride out anything Mother Nature brings.

The Power of the InternetYour phone is likely never very far away from your hand, which makes it one of the best choices for staying connected to weather forecasts and alerts. There are Wireless Emergency Alerts that can be sent directly to your phone, but you should also consider signing up for another reliable weather app in order to have the most information possible.

When you are choosing an app, make sure you are sticking with a nationally recognized organization. Seek out your nearest news station, since many of them offer apps that will keep informed on a multitude of situations. Make sure you sign up for alerts from the city as well.

Keep an eye on local weather forecasts when an event is predicted so that you are not caught off-guard if an alert is issued. This can also help you decide on any upcoming travel plans you may have and keep you up to date on shelters and evacuation orders.

Non-Electronic OptionsWhile our phones and other screens are great resources for staying well-informed, they also have batteries that will eventually run out. Make sure you have a way to continue receiving weather alerts and other news even if the power goes out long-term.

If there are weather sirens close enough to your home to hear, get to know the different sounds they make ahead of a storm coming in. Invest in an NOAA weather radio as well. These are portable, require no electricity and can give you accurate information through any kind of severe weather. Keep one handy even after a storm has moved through in case another system is close behind it.

Emergency alerts can save your life by getting you out of harm’s way, but that doesn’t mean your home won’t see some damage when storms get bad. If it does, call us day or night and start restoration immediately. We are local, which means we are ready to go the moment you need us.

Serious storms can cause serious property damage. Call SERVPRO® 24⁄7 for immediate restoration assistance.

Preparing for Spring Storms | SERVPRO of East Brownsville & South Padre Island

3/1/2024 (Permalink)

Let SERVPRO of East Brownsville & South Padre Island help you get from April showers to May flowers.

Let SERVPRO of East Brownsville & South Padre Island help you get from April showers to May flowers.

The warm weather of spring has arrived, and we know for our Texas home that means that plenty of rain and severe storms can come right along with it. It isn’t uncommon to see thunderstorms, flash flooding and even the occasional early season tropical-style storm during the spring months.

As spring pushes toward summer, the weather can intensify and the official hurricane season starts. With potentially volatile weather headed our way, it is important to be prepared.

All the preparations in the world won’t matter if you don’t have a way to receive weather alerts. Staying informed is one of the most important things you can do in order to safely ride out anything Mother Nature brings.

The Power of the InternetYour phone is likely never very far away from your hand, which makes it one of the best choices for staying connected to weather forecasts and alerts. There are Wireless Emergency Alerts that can be sent directly to your phone, but you should also consider signing up for another reliable weather app in order to have the most information possible.

When you are choosing an app, make sure you are sticking with a nationally recognized organization. Seek out your nearest news station, since many of them offer apps that will keep informed on a multitude of situations. Make sure you sign up for alerts from the city as well.

Keep an eye on local weather forecasts when an event is predicted so that you are not caught off-guard if an alert is issued. This can also help you decide on any upcoming travel plans you may have and keep you up to date on shelters and evacuation orders.

Non-Electronic OptionsWhile our phones and other screens are great resources for staying well-informed, they also have batteries that will eventually run out. Make sure you have a way to continue receiving weather alerts and other news even if the power goes out long-term.

If there are weather sirens close enough to your home to hear, get to know the different sounds they make ahead of a storm coming in. Invest in an NOAA weather radio as well. These are portable, require no electricity and can give you accurate information through any kind of severe weather. Keep one handy even after a storm has moved through in case another system is close behind it.

Emergency alerts can save your life by getting you out of harm’s way, but that doesn’t mean your home won’t see some damage when storms get bad. If it does, call us day or night and start restoration immediately. We are local, which means we are ready to go the moment you need us.

Serious storms can cause serious property damage. Call SERVPRO® 24⁄7 for immediate restoration assistance.

The Ways Your Home Can be Damaged | SERVPRO of East Brownsville & South Padre Island

11/17/2023 (Permalink)

If you discover damage in your residence, call SERVPRO of East Brownsville & South Padre Island right away.

If you discover damage in your residence, call SERVPRO of East Brownsville & South Padre Island right away.

Our homes face a multitude of threats on a daily basis. Strong storms blowing in, fire hazards, sudden flooding…even just the neighbors who care a little too much about their yard and send rocks flying through your window when they mow for the fifth time…could have you calling your insurance company.

We may face lots of potential threats, but we can’t let them interrupt our lives. Instead we should do everything we can to prepare for them, and that means learning as much as possible about the most common kinds of home damage.

SERVPRO of East Brownsville & South Padre Island is here to help when you do have damages, making recovery just as easy as being prepared.

The Biggest RisksWe are certainly not strangers to risk living in this part of Texas. We have seen hurricanes, flooding, tornadoes and even some unusual freezing temps that have resulted in damage to homes, streets and everything else in their path. Our homes are also challenged by the extreme heat waves we often see during the summer months.

Even with risks that will vary according to the time of the year, there are three kinds of damage we should all understand well in order to take steps to prevent it. Damage to the roof, water damage and fires are big threats that people around the nation face and need to prepare for.

Your home could be damaged by water in a multitude of ways, both from inside and outside your home. This might include coastal flooding, flash flooding or just a burst pipe. Your roof could be damaged as the remnants of a hurricane blow through, or it could be hit by a tree limb that should have been trimmed long ago. While most sources of fire are manmade, preventable accidents, they can also be started inside or outside of the home.

Compounding DamagesLiving through a single event is traumatic enough, but as reality begins to dawn on the full extent of your disaster, you will likely see compounding damage to your home. A flood can destroy your furniture, and then leave you dealing with mold that starts to damage your foundation.

A fire doesn’t just burn one part of your house, it sends smoke and soot damage into rooms that never even saw flames. On top of that, there is a good chance parts of your home will also be dealing with water and potential mold damage from the effort to put the fire out.

No matter what kind of disaster your home endured, your recovery process will need to happen in steps in order to make sure every base is covered.

When you call us, we start taking as much information over the phone as possible while we mobilize a team with the right equipment to head to your property. Our crew not only has the tools and training to handle water, storm or fire damage—we can handle your tear down and construction needs, too.

If your home has a flooded basement or a leaking roof, we will make our first priority getting everything dried out and saving as much of your property as we can. As we move along in the recovery process, we can replace roof beams and seal sections of your home in order to prevent mold growth and keep things structurally sound.

When a fire strikes in your home, we will tackle the most damaged areas first in order to secure the area and prevent potential damage from weather coming in. We will address the burned odor along with making sure every room near and far from where the fire was is smoke- and soot-free. Depending on how bad your damage was, we can tear down and rebuild entire rooms if that is what it takes to make your home truly yours again.

Not only do we start your recovery fast, day or night, we also work directly with your insurance company in order to create the smoothest process possible. Working with SERVPRO® means one call is all it takes to coordinate every aspect of your restoration. We are the only contractors you will need as we get your life put back together.

Does your home need restoration and you don’t want to make more than one call? Contact us to get everything handled by one team.

Safely Getting Through Winter Storms | SERVPRO of East Brownsville & South Padre Island

11/17/2023 (Permalink)

The winter season is almost upon us! SERVPRO of East Brownsville & South Padre Island has your back with these helpful tips.

The winter season is almost upon us! SERVPRO of East Brownsville & South Padre Island has your back with these helpful tips.

Winter storms certainly throw our community for a loop. They are pretty rare, but even in the most mild winter, we can never rule them out completely. Even if we are just hit with a freezing rain, it can leave our streets a mess and our homes at risk for damage.

No matter what our Texas winter brings, the more prepared we are, the safer we can stay. When we prepare our families and our homes, we can avoid a disaster and prevent costly repairs.

Preparing Your HomeWhen a winter storm is predicted, you want to get ready ahead of time so that you can stay off the road during the event. Heavy, cold rain can make driving very dangerous, especially if it is accompanied by thick fog.

Dig out your hurricane supplies and make sure your weather radio is in good working order. We know well that winter storms can knock out electricity, sometimes even long-term. Take a look at your other supplies and make sure you are well-stocked to stay home for a while.

You should have plenty of batteries and flashlights, as well as basic first-aid supplies. Gather up blankets and warm clothing, and consider how you will heat your home without power. If you have a generator, be sure to use it safely by following all manufacturer guidelines. Stock up on water and dry goods as well so everyone has plenty to eat and drink.

Just like during hurricane season, think about what your evacuation plans will be. If your home gets too cold, you may want to have an alternative place to stay with family or friends. Keep up with local news as well in case you need to seek out a warming shelter during the day or even overnight.

Taking Care of Your Home After the StormOnce the storm has moved through the area, head outside to assess your property. Even if your home doesn’t have any damage, there are some steps you will want to take to make sure it stays that way.

Check your roof for potential wind damage or any debris that may have piled up during the storm. If any ice has formed and is sticking around, you want to make sure your gutters are clear so that it can quickly move off of your roof and away from your home.

Once you know your roof is good, take a walk around your home and check for potential issues with your downspouts, siding or standing water near the foundation of your house. If your gutters have disconnected, correct them so they are ready for the next rain.

Check external vents all around your house to ensure limbs or other debris haven’t blocked them. Blocked vents can create a potentially deadly situation as carbon monoxide can build up inside you home.

How We Can HelpIf the storm did leave your home damaged, call us right away. We will get a team to your home quickly in order to secure things and start your recovery. We will start removing any water as we complete an assessment on what else your home will need.

Our crew will work fast in order to get your home put back to exactly the way it should be. We want to complete restoration so you can get back to enjoying the rest of winter.

Our team is always ready for anything! Contact us at SERVPRO of East Brownsville & South Padre Island for a quick restoration after suffering damage from a winter storm.

Outdoor Storm-Proofing | SERVPRO of East Brownsville & South Padre Island

9/19/2023 (Permalink)

Have you been impacted by the unusual summer storm season? SERVPRO of East Brownsville & South Padre Island has your back when you experience damage.

Have you been impacted by the unusual summer storm season? SERVPRO of East Brownsville & South Padre Island has your back when you experience damage.

High winds, heavy rains, hail, tornado, hurricanes…this isn’t the weather forecast, but it is a list of some of the ways weather can leave your home damaged. While every storm comes with different levels of extremes and your location certainly matters, the threats to your property are always there.

Your responsibilities as a homeowner can often seem endless, especially when it comes to home maintenance. When you add protecting your home from that endless lists of threats to your to-do list, it can quickly feel overwhelming.

Texas weather often creates a challenging situation when it comes to being prepared. In the spring and summer we have hurricanes, strong winds and heavy rains to contend with, while in the fall and winter we have thunderstorms and flooding to watch out for. Throw in the occasional tornado and the rare freeze and keeping your Brownsville home safe can feel like a full-time job.

The best place to start when it comes to weather prep at home is outside. Take steps to prepare the outside of your home for storms so that you can keep everyone inside safe.

Seasonal PrepsDon’t let getting ready for all the different kinds of weather we have become a daunting task. Preparing your home doesn’t have to be a challenge—most seasonal preparations can be worked into your regular maintenance routine.

Regardless of season or your home’s location, winds and rain will always be something you face. Trim trees in your yard, clear out your gutters regularly and pick up loose debris in order to prevent shattered windows or pooling water. Make sure items that live outside permanently, like patio furniture, are secured tightly. Keep the trash can close to a safe space so that you can stash it quickly when a strong storm is predicted.

When you are working outside, be intentional about walking around the entire exterior of your home. Check for gaps in bricks or siding and look for any signs of deteriorating wood.

Caulk around windows and door frames to prevent rain leaks, and check the roof often. You should check your roof at least four times a year thoroughly for loose or missing shingles, gaps around your gutters and any other aging that should be corrected. Take time to look at it after the winds have been high, too, so you can fix problems fast.

Home UpgradesYou can certainly prepare your home for storms at no cost with a little hard work, but there are also some home upgrades you should consider for an extra layer of protection when things get rough.

If your home does not already have them, storm shutters are a great investment. These can be permanent fixtures you can open and close at any time, or thicker covers specially designed to add on to your windows when hurricanes are predicted. Check the wind rating on your windows and look into upgrading to better materials in order to ride out storms a little safer. Gutter guards that prevent buildup are a great way to ensure heavy rains don’t spill over on your roof or cause ponding near your foundation.

If you have unattached buildings on your property, consider some additional structural reinforcements to prevent damage from winds. Modular homes should also be securely tied down to a solid foundation.

Weather alerts are an extremely crucial part of keeping everything safe and secure when things are predicted to be severe. Make sure you have two ways to receive every alert, and move to your safe space quickly when warnings are issued. If your home is damaged during a storm, call us. We are available around the clock to get restorations started fast.

Was your home damaged in a storm? Call us at SERVPRO of East Brownsville & South Padre Island to start restoration, 24⁄7.

What to Do When Your Home Is Damaged in a Storm | SERVPRO of East Brownsville & South Padre Island

9/19/2023 (Permalink)

Summer storms affecting your property? Call SERVPRO of East Brownsville & South Padre Island to restore your space in no time!

Summer storms affecting your property? Call SERVPRO of East Brownsville & South Padre Island to restore your space in no time!

Storms may be a regular part of life, but even something that happens often can still catch you off-guard. A thunderstorm can rip through town in a matter of minutes, leaving behind more destruction than what seems possible.

This part of Texas is very familiar with the destruction that a storm can create. While thunderstorms are common year-round, in the summer we see hurricanes, tropical storms, flooding and even occasional tornadoes.

Living in a tropical climate, we know that preparations are incredibly important before a storm. Taking steps to protect your home ahead of severe weather can prevent a lot of damage, but it may not stop them all. Knowing what to do after a storm is just as important as preparing beforehand.

Always make safety a top priority as you start taking the next steps toward your recovery.

Immediately After the StormIn the few moments after a storm has passed, take time to breathe, but don’t let your guard down. Continue to watch for lightning, rain and hail that could be lingering in the area, and listen for alerts in case another round is headed your way. Make sure you have a way to receive weather alerts and can get back to safe space quickly.

Reach out your loved ones if you have phone services to see who may need help. Text messaging may work even when cell service isn’t available, so it is crucial in your prep before a storm to let everyone know how to communicate with one another.

Check in on those around you, but avoid entering damaged buildings. Look for a safe exit, or clear a path for emergency officials. Take some pictures of your damage, and call SERVPRO of East Brownsville & South Padre Island. With our 24⁄7 services, we can start your recovery right away.

As More Time PassesAfter the initial shock of the storm is beginning to pass, the work that lies ahead of you will begin to unfold more clearly. Even if more than a day has passed, continue to be cautious. More storms are always a possibility, as is injuring yourself as you sort through debris. Watch for loose nails or other hazards and always have a way to receive weather alerts nearby.

The first priority of restoration should be preventing any further damages. When our crew gets to your house, they will start securing your roof, windows or anything else that needs sealing off to keep the elements out. They will also address any standing water and start drying out your property if needed. If your home is severely damaged, you may need to find a safe place to stay while the work proceeds.

At SERVPRO®, we work directly with your insurance company to ensure a smooth process throughout the entire recovery. Storm damage can be devastating, so finding ways to stay calm is crucial. With our crew on hand, your home will be as good as new faster than you could have ever imagined.

If a storm leaves your home damaged, contact us for fast recovery. We’re here 24⁄7 when you need us.

Whoa, That Was a Strong Wind! | SERVPRO® of East Brownsville & South Padre Island

6/5/2023 (Permalink)

If you've suffered from storm-related damage to your home or business, make SERVPRO of East Brownsville & South Padre Island your first call.

If you've suffered from storm-related damage to your home or business, make SERVPRO of East Brownsville & South Padre Island your first call.

Is there anything better than a cool breeze on a hot day? The wind is one of those things that we can’t touch, but we know it is always there. Most of the time, wind whipping through your hair feels like a sweet gift—but sometimes, it can create a complete nightmare.

When wind gets strong, it can quickly tear apart homes and lives in one fell swoop. We might only fear the possibility of these damaging winds when the weather turns severe, but sometimes strong gusts can blow through even while the skies are blue.

The more you get to know about the different kinds of winds that can leave your home damaged, the more proactive about prevention you can be.

The Different Kinds of WindWe are no strangers to strong winds in Texas, especially on the Island. While we can see hurricane force winds off of the coast, most reported wind damage comes after strong thunderstorms. No matter where the wind comes from, it is something we should always be prepared for.

Thunderstorms carry a lot of different threats, but any storm with lightning and thunder can also have winds that reach more than 60 miles per hour. When the wind gets that strong, it can easily pick up small sticks and other debris and toss them around like kids playing catch.

Straight-line winds are one of the most common kinds of winds that leave behind damages. These winds can be widespread and proceed or even precede storms, often reaching to nearly 100 miles per hour in single gusts. Straight-line winds include any kind of wind that is not associated with rotation, although these winds also exist in storms that carry tornadoes.

Tornadoes also come with a variety pack of threats, but they are considered so incredibly dangerous because of the different winds commonly found within them.

Straight-line winds, downdrafts that can take down a forest of trees, and bursts called micro- and macro-bursts all combine to create a trail of destruction that will likely take anything in its path out.

Wind Damage and PreventionWind often takes out trees, pulls down power lines and tosses around debris, but when it exceeds 80 miles per hour, it can also take out mobile homes, even when they are anchored down.

In order to protect your home and your family, get to know the different kinds of weather alerts that may be issued when winds are projected to get high. You should also secure loose objects to avoid creating projectiles around your home. Anything that lives outside permanently should be tied down, and for everything else, you should create a quick action plan in order to act accordingly as weather moves in.

Trees on your property should be trimmed regularly, with professional maintenance on those trees too tall to take care of on your own. Keep your yard cleared of loose limbs, too, which means you will need to be intentional about storm cleanup with all the winds our area sees throughout the year.

It’s likely you already have some emergency supplies gathered as we get closer and closer to hurricane season, but make sure you also have a safe space in your home you can quickly get to when high winds are in the area. An interior room without windows is ideal. Storm shutters are a solid investment as well for protecting your home.

After a storm has moved through, take a walk around your home to look for damages. Make sure you take special notice of your roof and gutter systems, as any issues in these areas can very quickly result in water damages.

If you spot problems, call SERVPRO. We are ready to respond day or night so that you can get your life put back together fast.

Has your home been damaged by wind? Call us and get things cleaned up fast.

Could Spring Showers Bring Your Home More Than Flowers?

4/3/2023 (Permalink)

Storm damage can be stressful, that's why the pro's at SERVPRO are on call 24/7 to help you when you need us the most!

Storm damage can be stressful, that's why the pro's at SERVPRO are on call 24/7 to help you when you need us the most!

Spring is almost here, and the changing season is always so exciting. You can finally put away for good the heavy coats you used once or twice and start planning to spend more time outside. While you do, think about how to best protect your home from the heavy rains and severe storms that come along with the toastier temperatures.

If you start spring-cleaning inside, make a list of things to do outside as well. Our area is prone to strong, windy storms so the more we can do to protect it, the less damage we will be at risk for.

Clean It OutAs the chill of winter leaves us behind, we need to look at any areas of our home that could have built-up debris. The rainy winter and the freezing temperatures we experienced a while back could have led to blocked gutters. When your gutters and downspouts are not clear, water can spill over onto your roof and leak into your attic.

You should also take the time to check exterior vents around your home. HVAC vents and dryer vents are susceptible to blockages from piled-up debris or ice, and if not cleared out, they could become a fire hazard.

Even if you only covered your outside faucets for that week of the deep freeze, take a look at them now for cracks or drips. Check pipes that run through the garage or other exterior locations as well in order to catch and fix problems promptly.

Fix Issues FastAlthough our winter is usually pretty mild in temperature, the rain we experience keeps a lot of us indoors for most of the season. This can make it challenging to catch problems starting in your roof or around your foundation.

Inspect your roof during a week with moderate temperatures to check for cracks in stucco or loose shingles. Make sure there are no gaps in your gutter system or any other visible damages.

A small problem can quickly become a big one, so the faster you are able to deal with an issue the better.

Get Ready for the WaterYour lower level is another area you want to address ahead of the rainy season. If you have a sump pump, inspect it to ensure it is working properly. Check for blocked drains or hoses to ensure that water has a clear path out in order to keep your foundation dry.

Get your emergency kit out and switch out any seasonal items. Spend time practicing you emergency plans with your family, and update batteries in flashlights.

Make sure you have two ways of receiving weather alerts, including one that does not require external power to work. Update your communication plans as well so that you know how to reach everyone in an emergency situation.

Even when your home is prepared, you could take on water during a storm. SERVPRO is available with the professionals and the equipment needed to start drying out your home 24⁄7. It is our goal to save as much of your property as possible so that you can get back home safer and faster.

Got water damage? We are here to help 24⁄7 and can restore your home quickly.

The Ways Storms Create Damage

11/2/2022 (Permalink)

The Ways Storms Create Damage | SERVPRO® of East Brownsville & South Padre Island

The Ways Storms Create Damage | SERVPRO® of East Brownsville & South Padre Island

Severe storms can ruin anyone’s night. When you own a home, not only do you worry about the safety of your loved ones, you also wonder how your property will fare.

Most modern homes are built to withstand a good deal these days, but sometimes a wild storm will still leave behind a wake of destruction when it blows through.

Thunderstorms can bring heavy winds, lightning and hail, snowstorms can carry freezing rains, and flash floods can happen year-round. No matter the season, there is always the potential for your property to end up damaged and the structure of your home to be threatened.

While sometimes what happens in a severe weather event comes down to just plain old luck, there are a few factors to consider when looking at your risks. The type of storm moving in, the general geography of your location, the landscaping around your house and even the construction materials your home is built with will all play a role in the damages you may receive.

Our Texas weather may be a nice treat to anyone who doesn’t like the cold, but living in this area comes with the threat of strong thunderstorms, hurricane activity and tornadoes. While we all know extra prep is required in order to ride out hurricane season safely, we should be ready for severe weather throughout the year in order to best protect ourselves and our property.

When storms do roll in, if your home is damaged, be sure that a professional has declared it safe to live in. You may not think the damage you can see is that drastic, but structural damage is not always immediately visible. Always heed evacuation orders and wait to return home until you know you can safely get there.

And learn as much as you can about common types of storm damage so that you know what to do to prepare for them:

Wind

Wind becomes destructive when it reaches top speeds. Tornadoes and hurricanes will always have a threat of strong winds even for those not in the immediate path, but even a thunderstorm can blow damaging gusts of up to 100 mph.

When winds reach those kinds of speeds, they can blow small objects into vehicles and buildings. If you are sheltering at home during a storm with high winds, make sure you stay in an interior room away from walls that can be pierced or windows that can be broken by flying objects.

You can take preventive action before a storm arrives to protect your home. Clear your property of any loose limbs, rocks or other small items that could become projectiles. Remove trees if they are dying before they can be knocked over. If you have furniture outside, tether it down so it stays put during a storm.

Water

Water damage is something we are very familiar with here, but it is also extremely common just about everywhere in the United States. Even a typical thunderstorm blowing through can dump enormous amounts of rain that can saturate soil and lead to water seeping in through doors or window seals.

If the ground takes on enough water or a flooding situation occurs, it can seep through your foundation and create structural damage from underneath your home.

With specific landscaping, you can help limit the amount of damage water can cause to your property. Create slopes that allow water to flow away from your home, and consider adding a rain garden. These are not only beautiful but are also highly effective at absorbing water before it can reach your home.

Your gutters are another important part of mitigating water damage to your property. Keep them cleaned and maintained to avoid water pooling on your roof, which can lead to leaks that damage your home from the top down.

Impact

“Impact damage” occurs when an object crashes into another object during a storm. This kind of damage can be catastrophic to your home as it typically involves fallen trees or wind blown debris. Impact damage can be caused by anything that can be picked up in the wind and makes an impact with your house or property.

This kind of damage can be avoided by trimming your trees, removing unhealthy trees from your property and limiting debris around your home.

In 2021, severe weather led to more that $145 billion in damages all around the United States. When you prepare your property, you can lower your overall risk factor, which will keep your home safe and save you money.

If your home is damaged in a storm, call SERVPRO of East Brownsville & South Padre Island. Our professionals are available 24⁄7 with the experience and equipment to get your restoration started and completed faster. Call us with any disaster you face, any time.

When you suffer storm-related damage to your home or business, it’s important that you know who to call! Contact us today to get your storm damage restoration started faster.

Hurricane Preparedness for Your Waterfront Property

7/12/2022 (Permalink)

Have Storm or Flood Damage?

Call Us 24/7 at (956) 747-3020 to schedule your inspection with us.

Have Storm or Flood Damage?

Call Us 24/7 at (956) 747-3020 to schedule your inspection with us.

Hurricane season is nearly upon us, and if you own waterfront property in Texas, you’ll want to be prepared for whatever the season may bring. While we all hope for a quiet hurricane season, we know that it’s best to be ready for anything.

Read on to find ideas to help you prepare your waterfront home hurricane season.

- Document & Secure Your Possessions

- Take pictures or video of your deck, seawall, and home exterior. Photos and video as well as lists can help when dealing with FEMA or insurance claims if a hurricane does strike.

Hurricane Preparedness for Window

- Invest in Hurricane screens. Lightweight, strong, and budget-friendly, hurricane screens can protect areas where shutters and other solutions may not be ideal, like large windows and open lanais.

Hurricane Preparedness for Doors and Garage Doors

- Impact Doors: Impact doors keep your home safe with special fiberglass or aluminum construction and reinforced jambs.

- Impact Garage Doors: If you have a garage, consider the addition of an impact garage door. Impact garage doors are made of special materials intended to handle the impacts of debris, heavy winds, and driving rain. They also feature reinforced hardware and rail systems, so the door will stay closed and strong through a storm, protecting your whole home.

When you are dealing with storm, flood, and water damage, immediate action is crucial. You should choose the company with storm damage experience and expertise that has the resources and equipment to handle the job.

SERVPRO of East Brownsville & South Padre Island can respond immediately to storm and flooding conditions.

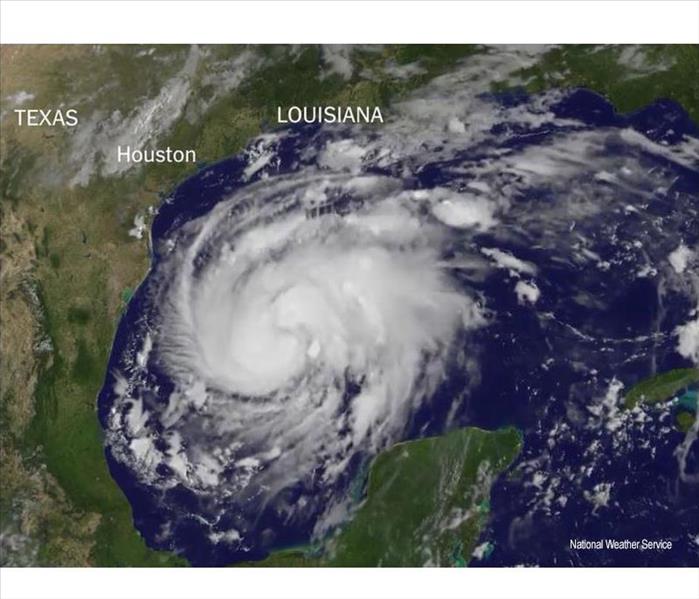

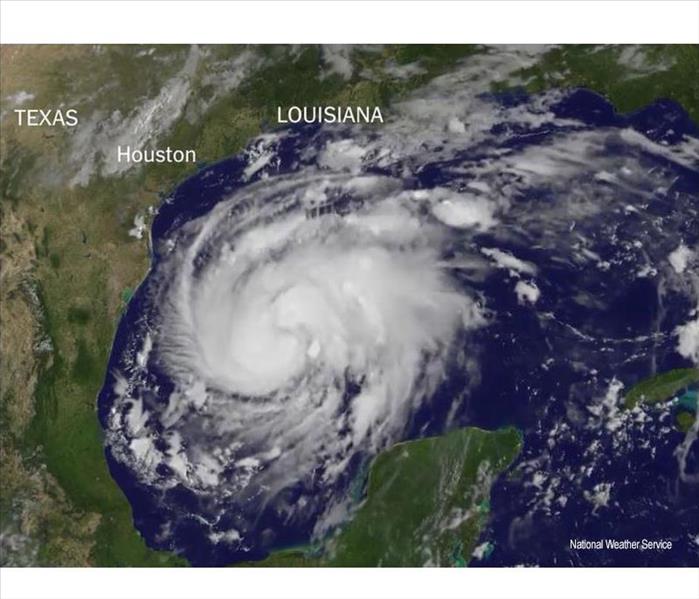

How to prepare for hurricane season

7/11/2022 (Permalink)

Have Storm or Flood Damage?

Call Us 24/7 at (956) 747-3020

Have Storm or Flood Damage?

Call Us 24/7 at (956) 747-3020

The National Weather Service recommends the following home preparation tips:

- Know the elevation of your home if you're in a flood or evacuation zone.

- Check mobile home tie-downs for rust & breakage.

- Mobile home residents should evacuate when told.

- Trim trees & shrubbery

- Inspect the roof for loose shingles.

- Consider replacing old shingles with new ones rated for hurricane winds.

- Clear clogged rain gutters.

- Reinforce garage doors or replace with a hurricane-tested door.

- Reinforce double entry doors with heavy duty foot and head bolts

- Install hurricane shutters, if possible, and inspect existing shutters

- Store lawn furniture and other loose, lightweight objects.

- If evacuating from home, turn off propane tanks, unplug small appliances, empty refrigerator and freezer, turn off utilities if told, lock home and take pets with you.

- If staying home, close storm shutters, notify family members of plans, lower swimming pool water level by 1 foot, turn refrigerator and freezer to coldest setting and only open, if necessary.

- stay in a safe room such as a closet, bathroom or hallway.

When you are dealing with storm, flood, and water damage, immediate action is crucial. You should choose the company with storm damage experience and expertise that has the resources and equipment to handle the job.

SERVPRO of East Brownsville & South Padre Island can respond immediately to storm and flooding conditions.

The 4 Things That Cause 3 Types of Flooding

4/7/2022 (Permalink)

Regardless of the cause of the flooding, SERVPRO of East Brownsville & South Padre Island has the team to help you recover from any disastrous event.

Regardless of the cause of the flooding, SERVPRO of East Brownsville & South Padre Island has the team to help you recover from any disastrous event.

Flooding is a major natural disaster, claiming more lives in the United States per year than lightning, tornadoes and hurricanes. This common event affects everything in its path from an individual home to an entire community or city.

Flooding occurs in all 50 states and all U.S. territories, and while the events are all slightly different, there are similarities in the types of flooding and the casualties that result from them. There are three types of flooding that are common, and four reasons they happen.

3 Types of Natural FloodingFlash floods are a commonly occurring type of flood that happens when intense rain covers an area and the ground is unable to absorb enough water. The excess water runs off quickly and can carry away small objects or even something as large as a car.

River floods happen when a river gains too much water too quickly and it begins to run over the banks causing damage beyond the boundaries of the river.

Coastal floods are floods that occur near large bodies of water. Storm surges, cyclonic activities and rising tides contribute to flooding near oceans and the gulf.

The 4 Most Common Causes of Natural FloodingHeavy rainfall. The past several years have brought extreme rains to Texas that have resulted in heavy flooding. Storms with excessive amounts of rain often move in and leave our grounds inundated, creating flash flooding and river floods. Our urban areas tend to be more susceptible to floods when these rains move in due to the lack of soil and increased area of concrete and asphalt.

Oceanic activity. Those in our South Padre Island community have come to understand the risk associated with rising tides, hurricanes and storm surges. This flood-prone area, along with the rest of our Texas coast, have seen the damage these massive floods can leave behind.

Dams and levees failing. The notable levee break in 2005 caused by Hurricane Katrina is something none of us can forget. Levee and dams break when they are cracked or under extreme pressure and can no longer contain the surge of water behind them. These breaches can create catastrophic flooding.

Snowmelts and ice dams. While our winters are mostly mild, we can occasionally see some pretty chilly weather, but nothing like our neighbors to the north that experience heavy snowfall and prolonged freezing temperatures. These areas of our nation deal with flooding caused by snowmelt and ice dams. Ice dams, or ice jams form when ice enters a river and creates a block, causing the river to overflow.

Regardless of the cause of the flooding, SERVPRO has the tools and teams to help your home or business recover from its disastrous effects. Contact us anytime when flooding or water damage makes a mess in your life.

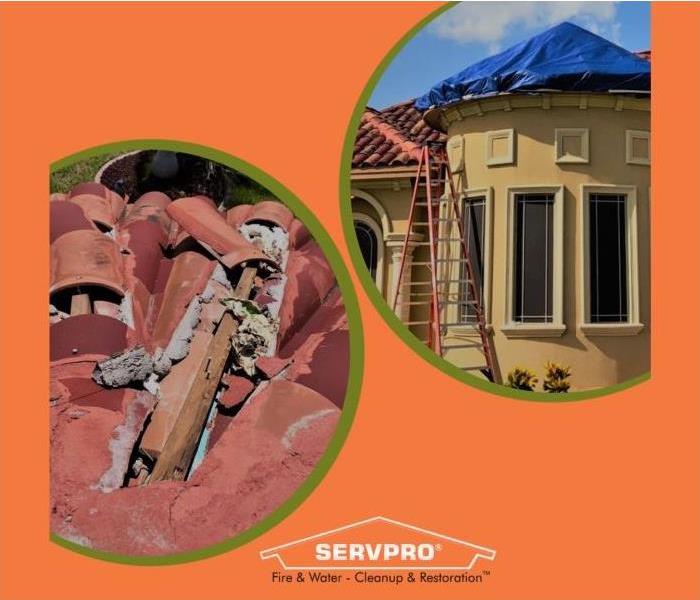

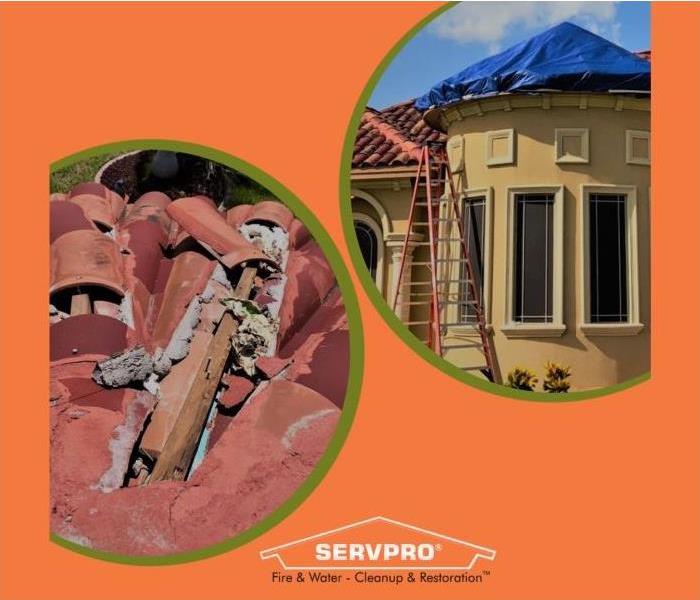

Wanna hear a roof joke...? It's on the house!

11/2/2021 (Permalink)

We have extensive water damage and storm restoration training that allows us to get your home back to normal quickly. 956-747-3020

We have extensive water damage and storm restoration training that allows us to get your home back to normal quickly. 956-747-3020

Heavy or not, storms don’t have a limit. A small rain can turn into a tropical depression without warning. One way to be a step ahead of the after damage of an unexpected storm is, roof inspections.

Having a roof inspection will come in handy when THERE’S a storm approaching. You wouldn’t believe the amount of calls we receive at 6 am letting know they are seeing right through their ceiling!

At SERVPRO of East Brownsville South Edinburg, we understand the high winds and rains near the island can get pretty intense. The last thing you want to worry about is a leaking roof, when you least expect it.

SERVPRO of East Brownsville & South Padre Island can simplify the restoration process by handling both the initial water damage mitigation and rebuilding the affected areas. Having one qualified company for the entire process can save time and keep costs low.

Have Water or Flood Damage?

Call Us Today – (956) 747-3020

Fall In Love with SERVPRO Storm Safety

11/2/2021 (Permalink)

We take pride in being a part of the Brownsville community and want to do our part in making it the best it can be 956-747-3020

We take pride in being a part of the Brownsville community and want to do our part in making it the best it can be 956-747-3020

Stay safe during this fall and keep yourself informed when and if a storm is approaching by watching your local news as much as possible.

One main thing to keep in mind during or after a storm is to never drive though flooded waters. Fall can often bring with it rainy weather, and heavy rains can be a common occurrence as September & October ae still part of hurricane season.

If you encounter fast moving water or a flooded roadway as you are driving or walking, its best to turn around and find another route. Abide by the, “Turn around, Don’t Drown” adage. You don’t know the conditions under the water. All it takes is 6 in of moving water to make you fall. Keep children and pets away from playing in flooded water, with the same mindset that we don’t know what’s in the flooded water.

At SERVPRO of East Brownsville and South Padre Island, we can scale our resources to handle any size storm or disaster. We can access resources from a network of 1,700 franchises across the country and elite Disaster Recovery Teams strategically located throughout the country.

How to prepare for a winter storm BEFORE it happens

11/1/2021 (Permalink)

We take pride in being a part of the Brownsville community and want to do our part in making it the best it can be.

We take pride in being a part of the Brownsville community and want to do our part in making it the best it can be.

First thigs first you want to make sure you get the alert that there’s a storm approaching. Here’s how to get set up weather alerts on your phone:

For iPhones: By default, this option is turned on, but can be disabled or verified by going to Settings > Notifications > Emergency Alerts.

For Android Phones: Settings > More > Cell Broadcasts (may be under Wireless Networks section) > enable / disable Extreme Alerts and Severe Alerts.

Now that you got your alerts on: Let’s get started

- Days before the storm arrives, fill up your gas tank. If you want to be extra prepared, take a gas can

- Stock up time. Make sure you have flashlights, candles (lighter), water and dry food that won’t go bad.

- Charge your phone and other electronics. If you want to be extra prepared, purchase a portable charger (just make sure its ALSO fully charged)

- If you have any generators and or large battery backups that you may have in the event of a black out.

- Check your vehicles anti-freeze

When you have a cleaning or restoration need, we’re already nearby and ready to help. We take pride in being a part of the Brownsville, TX community and want to do our part in making it the best it can be.

Hurricane Season with SERVPRO Brownsville-SPI

7/13/2021 (Permalink)

It's always busy at SERVPRO Brownsville-SPI, when we offer 24/7 round clock assistance! Call 956-747-3020 for more information!

It's always busy at SERVPRO Brownsville-SPI, when we offer 24/7 round clock assistance! Call 956-747-3020 for more information!

SERVPRO wants you to be hurricane ready at all times, so let’s go over some information you may need when preparing for hurricane season:

(Always remember personal/important medication/documentation for traveling).

Give yourself time to be prepared:

Meaning stock up on all the good stuff: from emergency disaster supplies, water, medicine supplies and food. Pay attention to any changes or updates in local guidelines about any evacuation plans and shelter. (Including shelters for your pets, if applicable)

You may need to evacuate:

Be prepared with a “go kit”. Include items that may also protect you and others, if available; like germ x, Lysol wipes, Lysol spray, bar or liquid soap. Medications, a change of clothes for everyone. (Consider food and water also, in the event your relocated and have no food you’re prepared.

Our blog “sign up for weather alerts TODAY!” posted on 07/02/2021:

We provide an extensive list of weather alerts you can sign up for and stay updated on storm updates in your region.

We care for the safety of our pets as well:

Have a disaster kit ready for pets. Get more information on the disaster shelter you have chosen, to see if they accept pets.

Staying with friends:

Go over any details in plans with your relative, assure that you all are on the same page. Remember to take your “go kit”. You may not need to take food or water if you are staying with a relative or clothing.

If you under go any damages during a catastrophic event, call SERVPRO East Mission/ South Edinburg. When being the professionals in clean up and restoration we assure you an experience “Like it never even happened.”

Storm Language

7/12/2021 (Permalink)

After/during a storm, some home owners experience roof leaks. In this time, our technicians use "tarping" as a technique to stop the water leakage.

After/during a storm, some home owners experience roof leaks. In this time, our technicians use "tarping" as a technique to stop the water leakage.

We’re in mid storm season and you know what that means. We hear them on the radio, on tv and even our phones send us notifications. I’m talking about WEATHER WATCHES! We all need to familiarize ourselves and educate our children on these terms to be alert in the event we are issued a warning. ESA

Know the lingo!

Flood Watch – this means an overflow of water from a river is possible for the area receiving this alert

Flash Flood Watch- this means that flash flooding is possible or close the area. These can be placed for as long as 12 hours.

Flood Warning- means flooding conditions are actually occurring in the warning area.

FLASH Flood Warning- this means that the flash flooding is ACTUALLY going on in the area. This may also be issued as a result of torrential rains or snow thaw.

In the event you suffer any home damages due to a storm, call SERVPRO Brownsville- SPI. Open 24/7, we can provide more information if needed at 956-747-3020.

"Is it still raining?"

7/7/2021 (Permalink)

Rain season is here, but so is SERVPRO Brownsville/SPI!

Rain season is here, but so is SERVPRO Brownsville/SPI!

Yes, it’s been constant rain for us valley regions these past couple of days. With that being said, we know that there’s only one thing we worry about and it’s the after math. We don’t say it out loud, but its lingering in the back of our head. The mess left behind is always our main and only concern. If your home/business is insured, get with your insurance agent and go over your coverage plan. If it’s necessary add flood coverage and textiles to your coverage, for the ultimate coverage, if ever needed.

Here are the first things you need to do when faced with a house flood.

Your safety comes first- we may not experience deep water flooding when living in the valley, but that doesn’t mean we haven’t had our years or could. Take into mind that if you experience flooding your health and safety should always come first. If you choose to turn off the main breaker wear proper clothing (boots, gloves if applicable) no food that has had long period of contact with the water should be consumed. (Take into mind you don’t know what contaminates the water). Move to higher ground if necessary.

Identify the source of the flooding and stop it- now this can apply in many ways i.e. if it’s a broken pipe turn off the main water supply. Now if its due to a hurricane o r you ismpply don tknow the root cause of the flood the simplest route to take is call a professional.

Document the damage- do remember to always video tape any damage affected by the damage before placing your call to the professionals for your own record purpose and for your insurance claim (if applicable).

Call your insurance provider (if applicable)- your insurance company will send you an adjuster to inspect the damage and if necessary, evaluate any losses.

Get help from a reputable water damage profession- so this is where SERVPRO Brownsville comes in! although we all get tempted to handle the job ourself, there’s no need to when we can help you the entire way. We go ahead and help you even with the insurance claim itself.

Avoid any further delays or damages and call us in the event you face an emergency. If you need any more information on our services call SERVPRO Brownsville/Spi, TODAY!

Are There Ways to Protect My Home After a Flood?

11/4/2020 (Permalink)

With a fast response and experienced technicians, our SERVPRO team can help your home return to preloss condition quickly.

After a flood loss in yourhome, you can wonder if things will ever look and feel the same again. Standing water alone can cause devastation throughout affected areas of your home, providing an overwhelming sight for the DIY restorer. Our SERVPRO team can help with a fast response to these emergencies when you call and the equipment and expertise to manage the current conditions and return your home to its original state.

While there are multiple degrees of flood damage in homes after a loss incident, several of the approaches necessary to restore the current effects are the same. We have pre-stocked trailers loaded with water restoration equipment like extractors, air movers, dehumidifiers, and potent cleaning products to help. Arriving quickly with these tools and technologies already in hand ensures that vital mitigation begins as soon as possible and that there are no further opportunities for irreparable structural damage.

What Are the Main Threats of a Flood Scenario?

Every flood situation comes with threats and risks to your home and its occupants. In many ways, this disaster is one of the most devastating that can befall a home, and that is why our professionals stay ready to respond to these water restoration needs as soon as you need it. Understanding some of the main threats to your property can help you know why you need to secure professional restoration to protect your house. Some of these pressing concerns include:

- Material Deterioration – Direct exposure to standing or migrating water after a flood can weaken construction materials.

- Microbial Threats – Moist and damp conditions created by the presence of floodwater and saturation of many materials can present the appropriate conditions for mold growth in as little as 48 hours.

- Contaminants – Natural flooding gets considered to be a blackwater incident, meaning that the likelihood of contamination and health threats are elevated.

- Structural Damage – The longer that materials stay exposed to water, the more likely that they become weakened and deteriorate.

Is There a Way to Help Before SERVPRO Arrives?

Often, homeowners want to do more to help their situation as soon as possible once disasters like flooding strike. While We’re Faster To Any Size Disaster and can often reach your property within hours of the first notice of loss, there are still ways to prepare for these possibilities and act when disasters strike in the small window before our competent professionals get there. Here is what you should do:

- Emergency Plan – Emergency plans are an excellent way to prepare for any loss situation that could impact your property. It assigns all of the occupants of your house with a path and destination so that they can safely get out of the house during a disaster.

- Keepsakes and Heirlooms – There is no doubt that you have some irreplaceable valuables in your home that can become ruined by rising or spreading floodwater. If possible, in the earliest stages of this emergency, you can relocate some of your home contents to other areas of the property or take heirlooms and treasures with you when you vacate the house.

- Turn Off Utilities If Possible – If it is possible for you to get to them safely, you can cut the electrical service throughout your home by severing the primary breaker in the box, shut off water service with a valve where the water comes from the meter into your home, and other similar steps. These steps prevent damage to these elements that can amplify the hazards or work to get done.

What Can I Expect from Professional Restoration?

While there is an allure to cleaning and restoring your home yourself, this is rarely feasible with flood losses, as so many areas of your property can become damaged without you even realizing it. We have sophisticated equipment to track water migration and the success of drying and restoration solutions that we implement. We have multiple strategies that set our professional restoration apart, and people have come to trust our SERVPRO team thanks to our immediate actions after a flood, including:

- Content Management

- Extraction

- Muck Out

- Drying

- Cleaning

No matter how detrimental a flood loss situation can be, the right preparations and fast responses can make a substantial difference. Our SERVPRO of East Brownsville & South Padre Island team can help with experience and capable equipment to make flood losses “Like it never even happened.” Give us a call today at (956) 747-3020.

How Can My Home's Flood Damage Be Remediated?

11/4/2020 (Permalink)

Flood Damage Remediation Companies Employ Various Methods to Return Your Home to Its Pre-Flood Condition.

Residents of Portsmouth are no strangers to powerful coastal storms and the flooding they often cause. Whenever this flooding affects you, it’s crucial that you quickly have it professionally cleaned up.

Flood damage cleanup companies, like SERVPRO, have a time-tested process for safely dealing with the hazardous results of flooding. This is important because if your home isn’t properly cleaned after such an event, it could lead to long-term health effects, substantial ongoing damage to your residence, and persistent foul odors. In order to avert these adverse effects, our technicians do the following things:

Quickly remove standing flood water from your home with powerful extractors.

Use ultra-low volume foggers to inject antimicrobials into affected surfaces.

Neutralize airborne microbes with thermal foggers.

Make interior temperatures less favorable for microbial growth with heated extractors and refrigerant dehumidifiers.

Use dehumidifiers to lower interior humidity to less than 60%, slowing the proliferation of bacteria and fungi.

Employ injectidry systems to dry difficult-to-access areas behind structural elements.

After SERVPRO workers complete these steps, residents are better protected from potentially harmful health effects and their home is less susceptible to developing mold/mildew damage, dry rot, and unpleasant smells.

Why Should I Not Attempt to Clean Up Flood Damage Myself?

Floodwaters are generally dangerous waters that have flowed over various surfaces, picking up a multitude of hazardous substances. These waters often contain one or more of the following: animal or human corpses, human and animal excrement, and toxic chemicals. It, therefore, takes the expertise and equipment of a company like SERVPRO to safely handle floodwater remediation. If you attempt to perform one yourself, you risk getting sick and likely cannot effectively eliminate the harmful microorganisms that cause long-term home damage.

What are the Options for Handling Water Damage After a Storm?

11/3/2020 (Permalink)

Flood Damage Calls for Careful Consideration to Ensure Your Property is Safe from Hidden Moisture

Significant damage may arise when you have flooding within your home after a recent storm. High-volume water loaded with contamination poses a threat to not only your belongings but also structural materials and framework. Acting rapidly is the smartest way to ensure you limit the loss and cut back on costs, which is where SERVPRO comes in. We are Faster to Any Size Disaster so that you have peace of mind in knowing that skilled technicians will be removing water and beginning restoration efforts in no time.

Will I Have to Worry About Exterior and Interior Wall Damage?

Any time you have flood damage, walls that come into contact with flood water might be compromised somehow. Our team includes skilled IICRC-certified technicians ready to use the latest water removal equipment, treatments to quell bacterial growth, and products inhibiting the onset of potentially harmful mold. Even though we have industrial-grade pumps and extraction tools, there might be a need for controlled demolition measures to remove any materials contaminated by floodwater.

We address walls in your home by doing the following:

- Interior walls – The interior walls may require flood cuts, which begin several inches over the waterline. Not only does this allow us to remove unsalvageable drywall, but it increased airflow and helps to gain access to any moisture or standing water inside.

- Exterior walls – All around your home where the water came in, we need to monitor and inspect exterior walls. We use moisture sensor technology to detect moisture pockets and tell us whether or not we must create drill holes for the water to drain out.

Our efforts will ensure your home gets restored to preloss condition, which is what sets SERVPRO of East Brownsville & South Padre Island apart from other companies in the area. When you need help with flood damage, give us a call 24/7 at (956) 747-3020.

What Can I Do To Clean Up the Flood Damage In My Home

11/3/2020 (Permalink)

Call SERVPRO of East Brownsville & South Padre Island When Your Home Faces a Flood Damage Emergency!

storm-related damages are always a possibility for your home. When it comes to the longevity of your home, it is essential to reach out for help when an emergency strikes.

Even when it is not hurricane season, Brownsville natives know that flood damage can still happen inside of their home. Spring thunderstorms can bring severe rain to your home, and a weak roof could allow that water into your home. If sudden storm-related damages occur in your home, reach out to a clean up and restoration company, like SERVPRO, immediately.

How Fast Can SERVPRO Get to My Home?

We always strive to get to your home as quickly as possible, because we understand that water-related damages wait for no one. To speed up the traveling process, we can:

• Try to avoid flooded roads

• Use GPS to ensure we take the fastest route

• Remove any obstructions as quickly as possible

When a storm hits, it's not always possible to arrive when you want to. However, here at SERVPRO, we can do everything in our power to arrive at your home when you need us and to do it as quickly as we can.

What Can Your Technicians Do to Remove the Water From my Home?

Floods can bring water into your home in the blink of an eye, especially when part of your roof gives way. Our technicians can do the following to help remediate the damage as quickly as possible:

• Use a tarp to cover the hole in your roof

• Use wet/dry vacuums, portable sump pumps, and extractors to remove excess water

• Employ technological devices designed to evaporate excess moisture

If you think your home needs flood damage remediation services, get help right now. Contact SERVPRO of East Brownsville & South Padre Island by calling (956)747-3020. We're here whenever you need us!

Some Warning Signs of Immediate Flood Damage Remediation Needed in Brownsville

1/10/2020 (Permalink)

Beginning the Recovery Process Following Brownsville Flooding

In an area positioned between multiple fronts capable of providing strong storm systems that can destroy Brownsville properties, residents and business owners in the area must remain vigilant to the possibility of disasters like flooding happening with little warning. Those in lower-lying areas of the region are more at risk for these circumstances, but any property is susceptible under the right conditions. Once the storm has passed, many homeowners return to their properties to begin the tedious task of assessing the damage.

Before you can address any of the flood damage in Brownsville homes following a disaster, you need to follow specific steps. The more that you can familiarize yourself with the process of acquiring professional restoration assistance and working with your insurance company to come to a solution, the less time gets wasted in securing restoration and recovery services for your property. Our SERVPRO team helps customers as much as we help homes, so you can depend on our experience in disaster relief to help you navigate the hurdles in your path.

As a premier restoration team in the region, we encourage homeowners to contact us directly when they first return to their damaged properties after a flood loss event. Though you might still wish to contact your insurance provider to see what coverage options you have regarding this situation, our team can already be at work mitigating your losses and protecting what structural elements we can. The longer that construction materials remain exposed to standing water and excessive moisture, the more they decay and deteriorate.

Our initial assessment of the property can help to provide your insurance company with the necessary documentation and photographic evidence needed to approve a damage claim you submit. Even when your provider can only cover the costs of specific recovery approaches, they still require this overall assessment and estimation of specific services to approve the filed claim.

Only re-enter your property after a flood if you are sure it is safe to do so. Many new threats could exist that came in with the rising waters, and structural elements could have become weakened to the point of collapse. No matter how we can help, our SERVPRO of East Brownsville & South Padre Island team is here for you. Give us a call anytime at (956) 747-3020

The Difference Between Storm VS Flood

1/9/2020 (Permalink)

Property owners may have a hard time differentiating storm damage from flood damage. Commercial properties can sustain water damage from either source. There are a few major differences to keep in mind that may help you manage these risks.

The most general distinction is that storm water comes from above, whereas flood water usually overspills natural bodies or courses of water and covers at least two acres of ordinarily dry land. Storm damage to a commercial property may originate from a variety of causes such as

• High winds

• Heavy rain

• Hurricanes

• Snow

• Tornadoes

Most business insurance plans provide protection from damage caused by storms. Property owners will need additional coverage to offset the expenses of flood damage. If your property is located on a flood plain, you should make sure you carry the policies necessary to protect your investment.

Flooding occurs when water overflows a body of water or watercourse such as

• Creeks

• Dams

• Lakes

• Storm-water channels

For water to be considered a flood, it must not only cover two acres but affect at least two properties. If a commercial property is located in a high-risk zone and the owner has a mortgage from an insured and federally-regulated lender, he or she is required to maintain flood insurance. Damage resulting from either flooding or storms can cause severe problems and should be planned for, prevented, and handled as soon as possible. Regardless of the source of moisture, the risk of mold and other secondary damage within a building can be just as severe.

Restoring Damage From Storms and Floods

Restoration specialists can help property owners determine the precise causes of damage and the best solutions. If a commercial property in Brownsville, Tx experiences flood damage or sustains damage during a storm, contact SERVPRO of East Brownsville & South Padre Island as soon as possible.

(956) 747-3020

Tips for Dealing with Storm Damage

5/23/2019 (Permalink)

When a storm has struck your home, SERVPRO of East Brownsville & South Padre island is faster to your disaster

When a storm has struck your home, SERVPRO of East Brownsville & South Padre island is faster to your disaster

The most common mistake when dealing with storm damage is calling your insurance company first. While you do need to be sure you call them within the window of time they allow for you to file a claim after a storm, there are some things you should do before you call them.

First of all, start with a high-quality, reputablestorm damage restoration company. They will fully inspect your property to find exactly what damage has occurred. They will often find storm damage that your adjuster would not have noticed, or perhaps even hoped you didn’t. By giving the adjuster a full property storm damage inspection report up front, you avoid missing out on repairs that should have been covered.

It is always best to find your own storm damage restoration company rather than go with one that the insurance company has “approved” because you want one that is working for you rather than the insurance company. You have paid your premiums so you deserve the best repair rather than the cheapest, which is what the insurance company would prefer.

You should also read over your policy before calling the insurance company so you know exactly what they should cover. All too often, homeowners hold back on claims out of fear they will be singled out for a rate increase after a storm damage claim, but this is not the case.

If you have suffered storm damage in your home or business, give SERVPRO of East Brownsville & South Padre Island a call. We represent your best interest, yet can work directly with the insurance company for claims up to $500,000 to make the process easier for you. We can provide you with an inspection and then complete the restoration for you. Our project management team has over 50 years of combined experience in construction, so we are confident we can restore your home to your complete satisfaction.

Storm Damage Is Not Always Immediately Visible!

5/23/2019 (Permalink)

Storm season is approaching, If your home has been affected by a storm, Remember SERVPRO of East Brownsville & South Padre Island is here to help.

Storm season is approaching, If your home has been affected by a storm, Remember SERVPRO of East Brownsville & South Padre Island is here to help.

Bad weather can be unpredictable, and when it is, homes are at risk of suffering. The worry is that it’s often difficult to tell just how serious the damage is.

Homeowners often ignore what is seemingly minor damage, not knowing that it is actually causing major issues within the building’s structure. Remember, serious storm damage is not always immediately visible. It may seem like there’s nothing to worry about, but actually, mold growth and ceiling stains are very often signs of a more sinister problem.

At SERVPRO of East Brownsville & South Padre Island, we suggest that you first walk around your home when the storm has passed to check for any visible signs of debris and damage, But please don’t climb on your roof, as this could be potentially dangerous. Leave this task to the professionals.

If your home has survived a severe storm, we recommend that you schedule an appointment for us to come and take a look ASAP. If you wait for obvious signs of damage, you may be putting your entire home at risk. Moreover, if your roof or other structural elements have suffered storm damage, your insurance should cover the cost of repair and restoration.

We are a fully licensed general contractor specializing in insurance restoration. We also offer 24/7 emergency home restoration services on mold, water, fire, smoke and storm damage, as well as vandalism or any other disaster that may strike your home.

Getting Speedy Storm Damage Repair Can Make All the Difference

5/23/2019 (Permalink)

When hurricane Harvey struck, our storm team made sure to help all of those affected by the storm.

When hurricane Harvey struck, our storm team made sure to help all of those affected by the storm.

Mother Nature can sometimes be brutal on our homes and buildings. You’ve likely seen footage of the damage that was caused by major storms such as hurricanes or tornadoes, but the reality is that any storm with strong winds and heavy rain can do a number on your house. For example, a tree branch could get knocked against your roof or windows, or perhaps some power lines might come down on your home. Once you’ve survived the storm, trying to figure out how to take care of the storm damage repair can be a major pain. Where do you even start with something like that?

The good news is that your home insurance usually covers these kinds of repairs. Your best bet is to contact our office immediately to schedule services. SERVPRO of East Brownsville & South Padre Island specializes in storm damage repair and can come and take a look at the damage. One of the extra things that we do for our clients is to work directly with insurance companies and make sure that we get the repairs taken care of on your home without providing any unnecessary financial burden on you. This is why there is no reason to fret over a large repair from storm damage that has been dealt to your home.

In the past, we have helped many home owners all across North Carolina get their storm damage quickly taken care of. So no matter what happens to your home, you can rest easy knowing that our team of SERVPRO professionals has you covered. Feel free to contact us if you have any questions about our emergency storm damage repair services.

Call Us After Wind or Storm Damage We Are Crisis Recovery Professionals!

5/23/2019 (Permalink)

SERVPRO has the proper training and equipment to handle any storm damage.

SERVPRO has the proper training and equipment to handle any storm damage.

High winds and storms can cause serious damage to buildings and homes – sending trees through windows, ripping off siding and shingles, and causing severe structural damage. If you have been the victim of storm damage, contact us – we are the crisis recovery experts.

Homeowners and businesses have trusted us for over 50 years. Our team has vast experience in insurance restoration, insurance adjusting and construction. In the wake of a storm, homeowners and businesses can count on us 24/7. Our storm damage restoration professionals offer turnkey services to get properties back to normal.

When we work for you, you have a trusted partner in every step of the process, from re-installations to repairs and temporary board-ups. Moreover, our 24-hour disaster response service means that no matter when a hurricane, tornado or storm strikes, we’ve got you covered. Our services include:

• Inspection to determine the extent of storm damage

• Negotiations with your insurance company to ensure you get a fair settlement

• Cleanup of debris

• Temporary security measures that include board-ups for doors, windows, roofs, etc.

• Roof damage repair

The Dangers Of Standing Flood Water From A Storm

1/9/2019 (Permalink)

Contact Us today for any storm/water damage.

Contact Us today for any storm/water damage.

Storms cause much destruction, and devastation every year. Some of the biggest dangers caused by storms occur right after the storm has already passed. Standing flood water that was caused by storms can cause serious health risks. Here are some of the most severe problems floods can bring.

Health Dangers

Standing flood water is filled with health risks. They are teeming with diseases. Bacterial infections, and diseases become a greater possibility because flood water can infect anything it touches. This includes anything from clothing to toys that children play with. Its important not to drink or eat anything that has been contaminated by standing flood water, and always wash your hands as often as possible, especially before meals. Open wounds pose a far more greater risk of becoming infected. If possible, keep opened wounds out of the water or cover with waterproof bandages.

Physical Hazards